SPOILER ALERT!

What Are Insurance Coverage Insurance Claims Insurer - Should You Employ One?

Content author-Woodard McLain

A public insurance adjuster is an independent claims handler/claims expert that represents for the policyholder in discussing and aiding the insured/ guaranteed event in assisting to settle its insurance claim. Public Adjusters is independent insurance agents. They are accredited by the California Insurance Coverage Code Section 766. Public Insurers is not used by the insurance provider, yet are independent insurance policy agents that are responsible for the fiduciary obligation of recommending their clients regarding various matters associated with their insurance plan.

Public Insurers has 3 major tasks. First, they have to submit all ideal cases types and records. Second, they must prepare the documents to correctly discharge or settle the claim if it is rejected by the insurance provider. Third, they should provide the customer with an estimate of all needed repairs or remediation work.

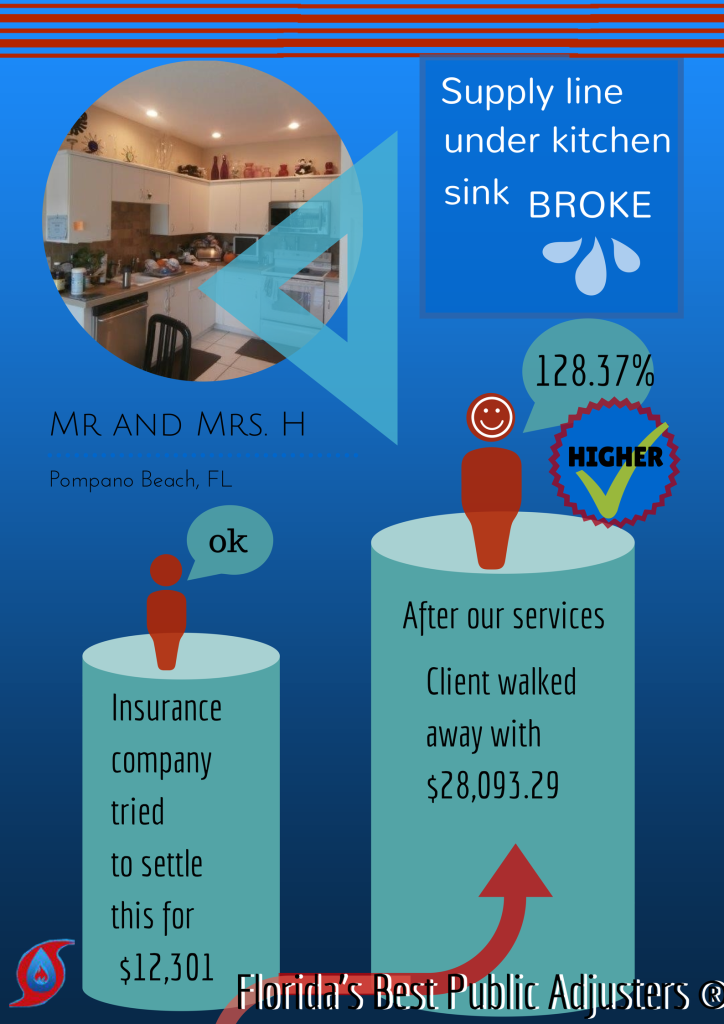

Insurance companies make use of Public Insurers to make the decision of the settlement amount on smaller cases. The Insurance coverage Department does not factor in the general public Adjuster's recommendation when making these resolutions. If a Public Insurance adjuster believes the negotiation quantity must be higher than what the insurance company determines, she or he will suggest the customer to sue for loss backup. If the customer does so, the Public Insurer obtains a portion of the declared negotiation. If the insurance company agrees, after that the general public Insurance adjuster concerns a decision in the case and forwards the referral to the client.

Insurance coverage agents who represent the general public Insurer additionally play an important duty in the entire negotiation procedure. In most cases, these individuals have access to sensitive details. When the general public Insurance adjuster establishes that a negotiation amount must be more than what the insurance provider identifies, the insurance policy insurer provides the information to the client. Insurance policy agents might suggest their customer to take the offer from the insurance provider, if they do not wish to take the chance of having to pay more damages. Insurance policy adjusters are often the last hope for customers that do not have the moment or sources to go after different avenues.

Just how can you ensure that you do not come to be the following target of Insurance Insurance adjuster abuse? The easiest method is to just ask the Public Insurance adjuster for paperwork concerning his or her recommendations. An excellent Insurance representative will be more than satisfied to supply such paperwork. In fact, it's far better to have actually documented proof showing that your case was indeed justified, instead of having to consider hasty treatments that may damage you in the future. In addition, you need to guarantee that you totally understand the function that the general public Adjuster plays in your insurance coverage market.

Insurance Coverage Representatives for Residential Property Insurance (PIP) are needed by regulation to be impartial. To do this, they have to register with a nationwide organization. The National Association of Insurance Coverage Commissioners (NACH) has detailed guidelines and standards on how participants ought to act. Amongst these are terms that insurers openly represent the passions of all policyholders, also those who may have a various point of view. Although NACH makes sure that insurance holders are treated rather, it does not ensure that they will certainly always act in your benefit. Consequently, it's constantly important to consult NACH before agreeing to keep a PIP representative or insurance adjuster in your place.

What is much more disturbing about the current news stories is that several of the people whose houses were damaged had not been appropriately notified. smoke claim of homeowners just minimize the loss, believing that insurance policy insurers will figure out any kind of troubles without any trouble at all. In truth, insurance companies are not simply concerned with the payout, yet additionally with making certain that their customer's home is structurally sound. This is why it is important that home owners do their very own research and contact neighborhood public adjusters and experienced home assessors to help them analyze the damage. If home owners also question the authenticity of a PIP rep, it's best to avoid the circumstance completely, as fraud is equally as actual as negligence.

Clearly, property owners have a number of issues when it comes to insurance claims adjusters. https://wgntv.com/news/wgn-investigates/chicago-families-claim-they-lost-insurance-money-to-scammers/ are extremely real worries that deserve major factor to consider, even when property owners really feel that they should have some input. As more house owners realize the benefits of speaking to regional PIP representatives as well as hiring them for their solutions, the number of issues as well as mistakes must start to recede. Offered these points, it is clear that house owners need to make themselves much more familiar with all the ways they can protect themselves from the dangerous whims of insurance adjusters.

A public insurance adjuster is an independent claims handler/claims expert that represents for the policyholder in discussing and aiding the insured/ guaranteed event in assisting to settle its insurance claim. Public Adjusters is independent insurance agents. They are accredited by the California Insurance Coverage Code Section 766. Public Insurers is not used by the insurance provider, yet are independent insurance policy agents that are responsible for the fiduciary obligation of recommending their clients regarding various matters associated with their insurance plan.

Public Insurers has 3 major tasks. First, they have to submit all ideal cases types and records. Second, they must prepare the documents to correctly discharge or settle the claim if it is rejected by the insurance provider. Third, they should provide the customer with an estimate of all needed repairs or remediation work.

Insurance companies make use of Public Insurers to make the decision of the settlement amount on smaller cases. The Insurance coverage Department does not factor in the general public Adjuster's recommendation when making these resolutions. If a Public Insurance adjuster believes the negotiation quantity must be higher than what the insurance company determines, she or he will suggest the customer to sue for loss backup. If the customer does so, the Public Insurer obtains a portion of the declared negotiation. If the insurance company agrees, after that the general public Insurance adjuster concerns a decision in the case and forwards the referral to the client.

Insurance coverage agents who represent the general public Insurer additionally play an important duty in the entire negotiation procedure. In most cases, these individuals have access to sensitive details. When the general public Insurance adjuster establishes that a negotiation amount must be more than what the insurance provider identifies, the insurance policy insurer provides the information to the client. Insurance policy agents might suggest their customer to take the offer from the insurance provider, if they do not wish to take the chance of having to pay more damages. Insurance policy adjusters are often the last hope for customers that do not have the moment or sources to go after different avenues.

Just how can you ensure that you do not come to be the following target of Insurance Insurance adjuster abuse? The easiest method is to just ask the Public Insurance adjuster for paperwork concerning his or her recommendations. An excellent Insurance representative will be more than satisfied to supply such paperwork. In fact, it's far better to have actually documented proof showing that your case was indeed justified, instead of having to consider hasty treatments that may damage you in the future. In addition, you need to guarantee that you totally understand the function that the general public Adjuster plays in your insurance coverage market.

Insurance Coverage Representatives for Residential Property Insurance (PIP) are needed by regulation to be impartial. To do this, they have to register with a nationwide organization. The National Association of Insurance Coverage Commissioners (NACH) has detailed guidelines and standards on how participants ought to act. Amongst these are terms that insurers openly represent the passions of all policyholders, also those who may have a various point of view. Although NACH makes sure that insurance holders are treated rather, it does not ensure that they will certainly always act in your benefit. Consequently, it's constantly important to consult NACH before agreeing to keep a PIP representative or insurance adjuster in your place.

What is much more disturbing about the current news stories is that several of the people whose houses were damaged had not been appropriately notified. smoke claim of homeowners just minimize the loss, believing that insurance policy insurers will figure out any kind of troubles without any trouble at all. In truth, insurance companies are not simply concerned with the payout, yet additionally with making certain that their customer's home is structurally sound. This is why it is important that home owners do their very own research and contact neighborhood public adjusters and experienced home assessors to help them analyze the damage. If home owners also question the authenticity of a PIP rep, it's best to avoid the circumstance completely, as fraud is equally as actual as negligence.

Clearly, property owners have a number of issues when it comes to insurance claims adjusters. https://wgntv.com/news/wgn-investigates/chicago-families-claim-they-lost-insurance-money-to-scammers/ are extremely real worries that deserve major factor to consider, even when property owners really feel that they should have some input. As more house owners realize the benefits of speaking to regional PIP representatives as well as hiring them for their solutions, the number of issues as well as mistakes must start to recede. Offered these points, it is clear that house owners need to make themselves much more familiar with all the ways they can protect themselves from the dangerous whims of insurance adjusters.